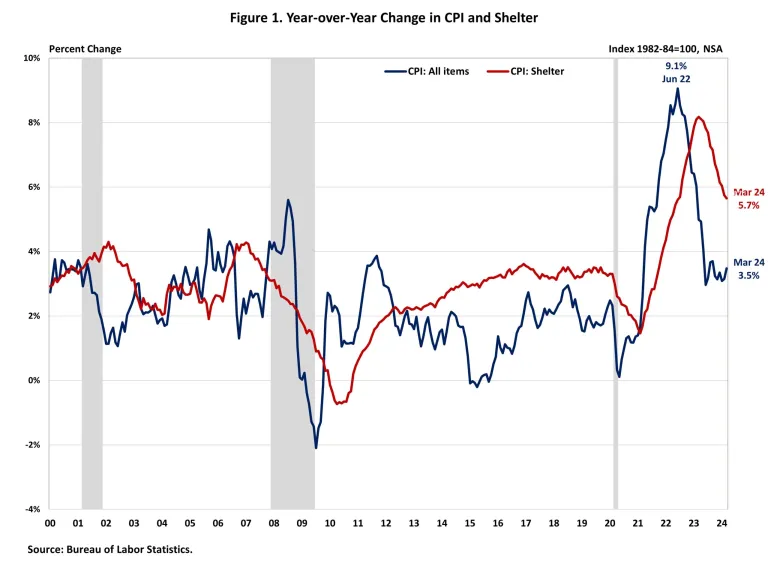

Despite a slowing in year-over-year growth, shelter costs continue to push inflation higher, accounting for more than 60% of the overall increase in all categories excluding food and energy.

This persistently high inflation is likely to keep the Federal Reserve on hold and delay rate reduction this year.

The Fed’s capacity to manage growing housing costs is restricted because they are caused by a scarcity of affordable homes and rising development expenses. Increased housing supply is the major solution to reducing housing inflation. The Fed’s powers for boosting housing supply are limited.

In reality, additional monetary tightening would reduce housing supply by raising the cost of AD&C borrowing.

The graph below shows that, despite Fed policy tightening, shelter costs continue to grow.

Nonetheless, the National Association of Home Builders (NAHB) forecasts that housing prices will fall further in the following months, citing real-time data from private suppliers indicating a slowing of rent rise.

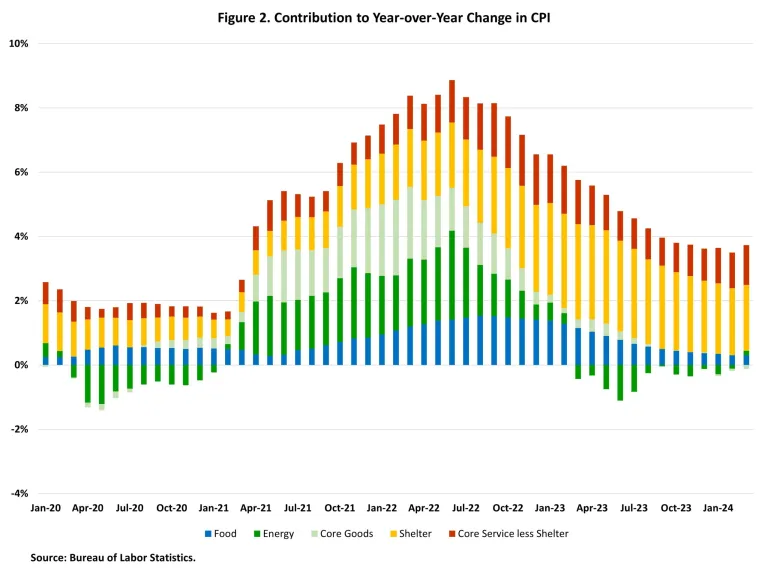

CPI Breakdown

- According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) climbed 0.4% on a seasonally adjusted basis in March, matching the gain seen in February.

- The energy index grew by 1.1% in March, with price increases in gasoline (+1.7%) and electricity (+0.9%) outweighing a decrease in fuel oil (-1.3%).

- The food at home index remained stable, while food prices increased by 0.1%.

- Excluding food and energy (“core” CPI), the index increased by 0.4% in March, following the previous two months.

- In March, the shelter index (+0.4%) and gasoline (+1.7%) accounted for more than half of the monthly increase in the overall CPI.

Other top contributors that increased in March included motor vehicle insurance (+2.6%), medical care (+0.5%), and clothes (+0.7%).

Meanwhile, used cars and trucks (-1.1%), recreation (-0.1%), and new vehicles (-0.2%) all had price decreases.

The shelter index, which accounts for more than 40% of the “core” CPI, rose by 0.4% in March and was the largest contributor to the monthly increase in all goods except food and energy.

The indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) both rose 0.4% this month.

These advances have been the most significant contributions to headline inflation in recent months.

Over the previous twelve months (not seasonally adjusted), the CPI increased by 3.5% in March, following a 3.2% increase in February.

The “core” CPI, at 3.8%, stayed constant from the previous two months, representing the weakest annual increase since May 2021.

Food prices grew by 2.2%, while the energy index rose by 2.1% year on year, marking the first 12-month gain since February 2023.

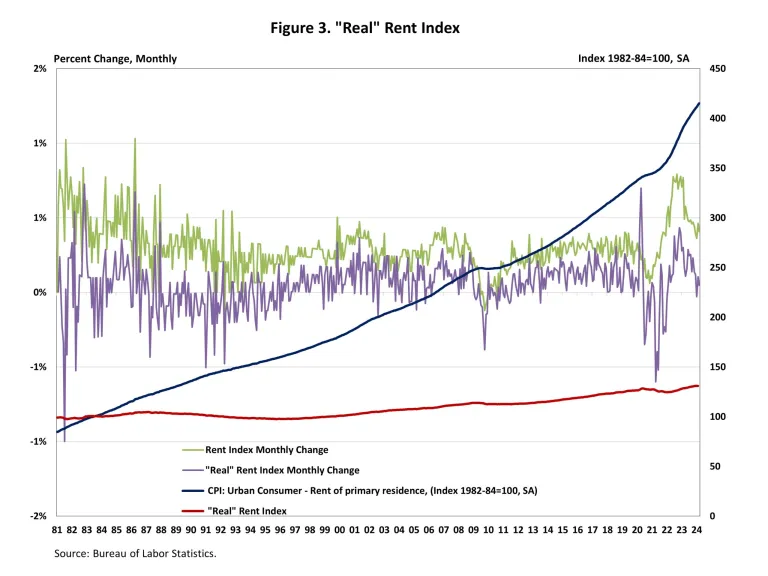

The NAHB creates a “real” rent index to determine whether rent inflation is surpassing overall inflation, which provides insight into rental housing supply and demand circumstances.

The Real Rent Index was unchanged in March.

(Source: Buildradicals.com)